The Member Experience Opportunity

We worked with DCU to overcome disruptive risks by undertaking ethnographic member insights research.

We worked with DCU to overcome disruptive risks by undertaking ethnographic member insights research.

Digital Credit Union (DCU) is the largest credit union in New England and in the top twenty nationwide. This is largely due to word-of-mouth and member loyalty. Because credit unions are employee- or member-owned, member-centricity was always core to DCU’s culture. But, despite a long track record of delivering excellent in-person service, the results were proving uneven in a digital-first world.

DCU has a core customer-base that is very loyal because of the personalized service they received over the years. And many of their employees offer truly exceptional customer service. But, digital presented risks to retention and growth given younger generations’ shifting expectations and behaviors. We sought to address risk in three key areas:

Members want the best products, services, and advice. Increasingly, online services allow people to find, compare, and switch to the best solutions with ease. This ability could threaten DCU member retention and share of wallet.

While members expect the best value, DCU cannot expect to grow through a race to the bottom. To forestall commodification, DCU must avoid selling disconnected products to offering solutions that satisfy members’ financial dreams.

As DCU is exposed to national competitors, its members have more choices than ever. Experience—specifically journey management—would be critical to retain and attract members in a changing financial services environment.

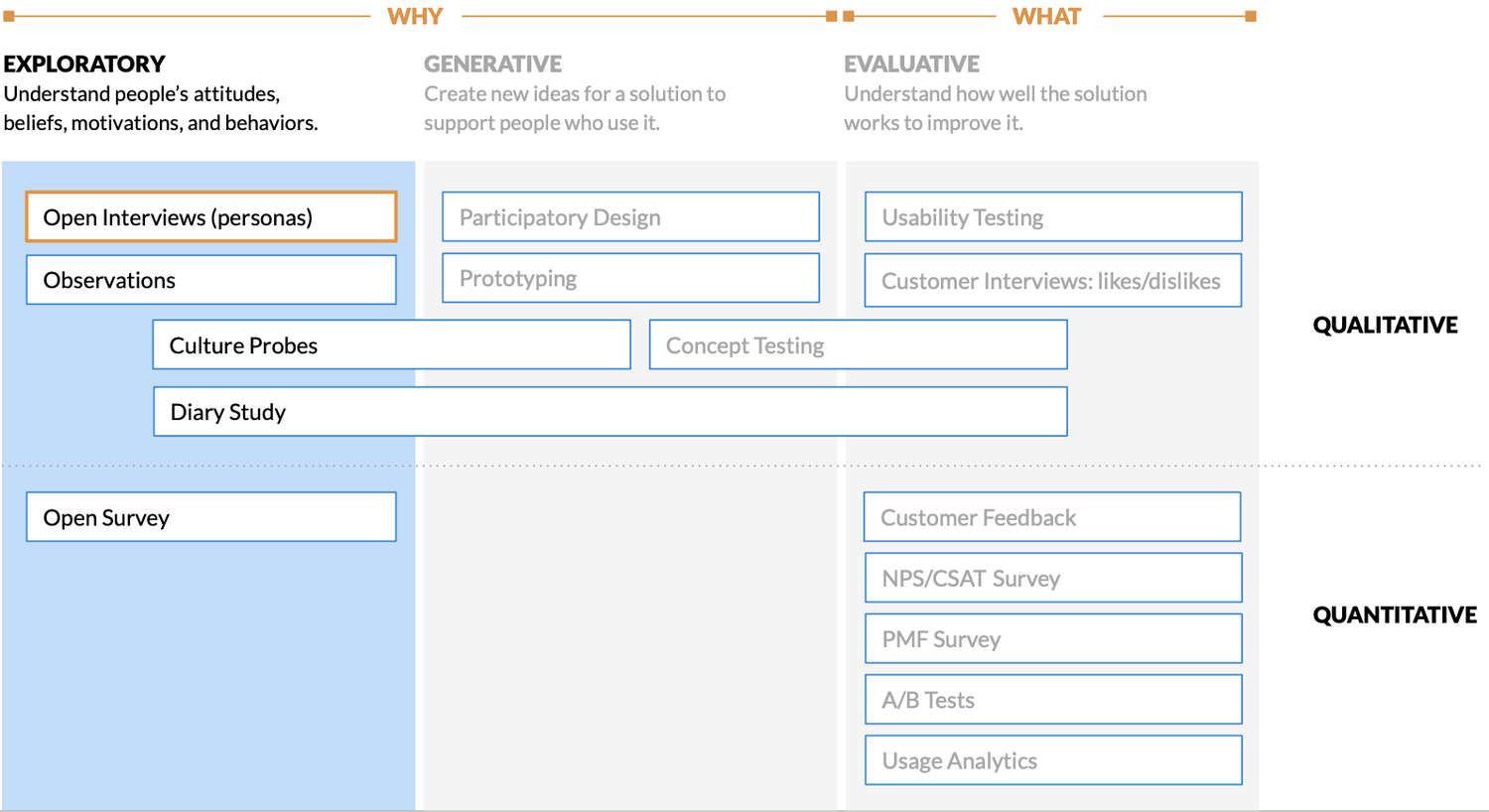

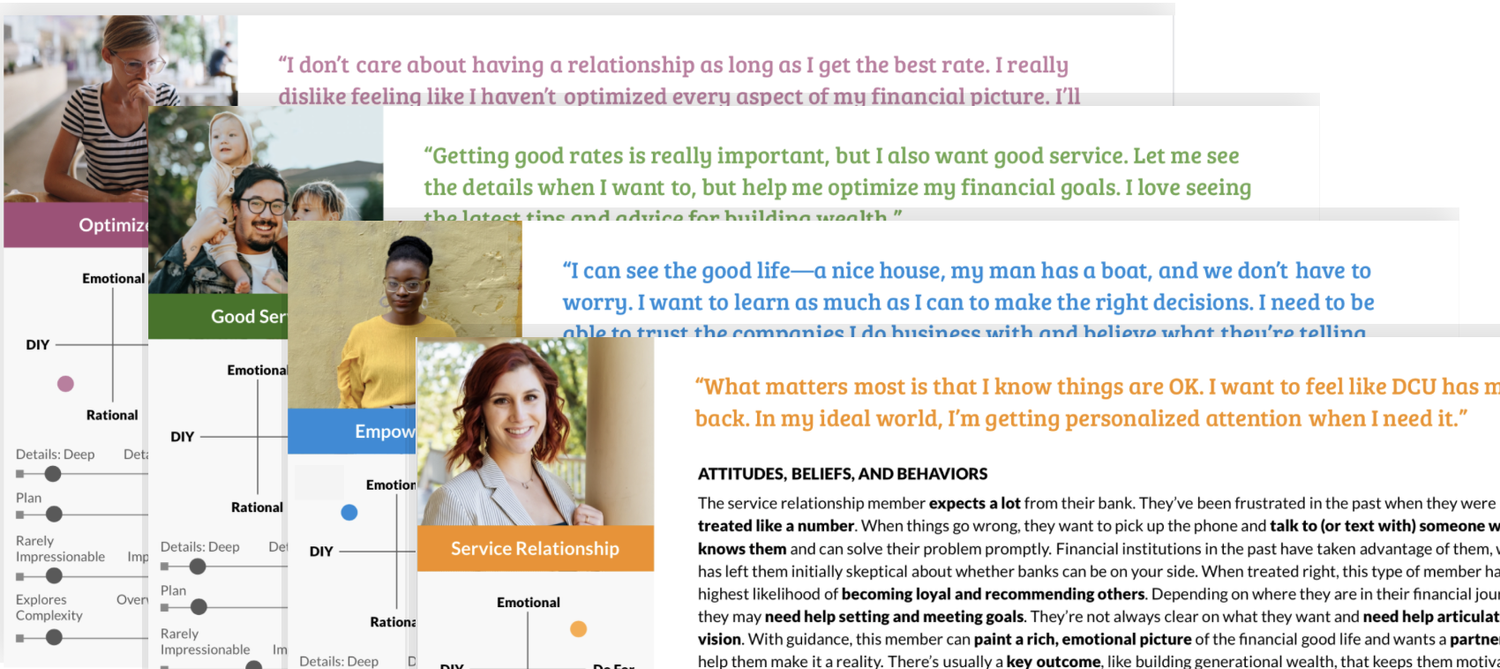

We worked with DCU to overcome these disruptive risks by undertaking ethnographic member insights research. Our work identified 21 actionable opportunities across four themes. We further distilled insights into behavioral personas that drove segmentation in member journeys and unblocked digital engagement through personalization.

If you are interested in learning more about this engagement or how Cantina can help you with a project contact us today. We'd love to help.