A new bar has been set

2020 accelerated the self-service economy, advancing a growing problem in the financial services industry - Friction.

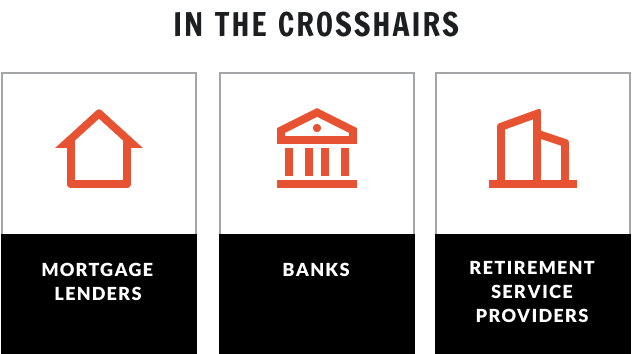

Unnecessary friction with customers can stem from a number of failings, like poor UX, lack of product transparency, or failing to leverage customer and market data. The end result for the customer might be a branch experience inconsistent with the online expectations, a burdensome onboarding process that leads to abandonment, or a retirement planning experience that fails to engage or motivate; all of this friction leads to frustration that will sour your growth, erode customer loyalty, and present opportunities for competitors.

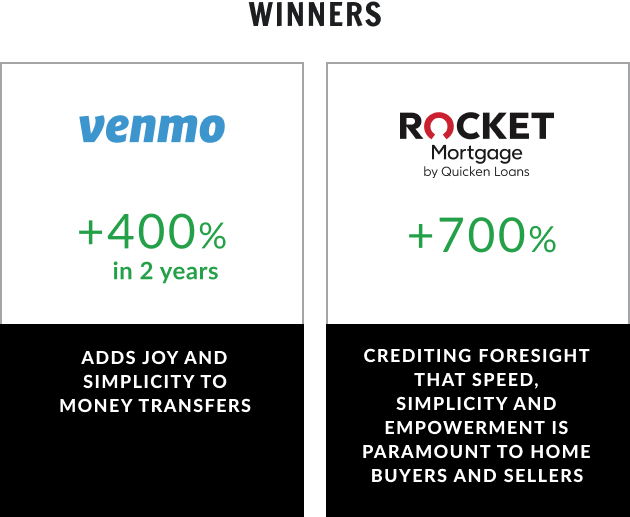

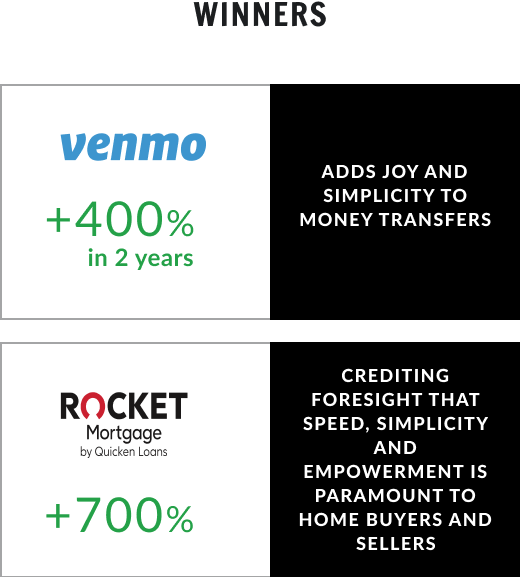

Disruptive companies are identifying these opportunities, smoothing out the friction, and creating lightning-fast experiences that drive higher customer loyalty and steal your customers. And another major threat is looming from the masters of online engagement and customer loyalty... Big Tech. When they really lean in, the financial industry needs to be ready.